Financial Security

Most of my friends are in the ‘mature’ age category – middle ’50’s and up. Many of them have questions about what to do with their investments. And how to figure out how much money they need to retire. In short, they are looking for advice on how to achieve ‘financial security’.

Financial Security – I have it, and did not make lots of money as an architect. So, what’s the secret?

Since retiring several years ago (2008), I have had several friends ask me for money advice. They are still heavily involved in their careers, but unsure of what to do about retirement finances. It is confusing now, there are so many different investments available and so many advisors and companies competing for soon-to-be retirement age clients.

To simplify my own confusion, I think back to how it was when I was a kid and earning some money. My dad taught me exactly what to do. Put your paycheck in the bank, until you have a little extra, then open a savings account. Earn 3% on your passbook savings. When you’ve saved $500, go look for a $500 car. Buy nothing on credit. You want a house, save up 10% of the price for the down payment. Back then, no one I knew invested in stocks and there weren’t C.D.’s, annuities, stock funds or other vehicles from which to choose. In the 60’s, managing your money was simple: earn a paycheck, save what you could, and use your savings to buy the expensive things: cars and houses. In the 60’s, you had to wait to get things. The only OK loan was a house mortgage, that was the American way.

I still revert to that system when I start to think there must be an easier way to make money faster.

Yes, I invested in the stock market, mostly through various funds available in my 401K, and yes during the ’85-2005 run up, I made a good return from stock funds and bond funds, averaging 8% for 20 years. But every time the market was off for a year or two, it made me sick to see my nest egg decline. As I got closer to retirement, I changed my thinking. Instead of blindly following the investment checklist for diversification according to my ‘risk tolerance’, I changed my plan to fit my personality much better.

My ‘risk averse’ plan: 90% of my nest egg was transferred to ‘can’t lose’ investments such as C.D.’s, annuities and money market funds. 10% was available for me to take risks with and try to make a really good return. This 90/10 ratio applies to liquid funds, not including house and car, which should be fully paid off.

This last strategy was in place as the stock market retreated to a 12 year low (DJIA 6,547) in March 2009. Yes, I ‘lost’ half of the investments I had ‘at risk’, but the loss was less than 5% of my liquid net worth. I am in the stock market now only in individual stocks (no stock funds), using them as my gambling fix. In the last year, I have made back all the ’08-’09 losses, and much more.

Here is my proven simple plan for financial security:

1. Pick a career you like. Consider success in your career as a return on your investment in it.

2. Get and keep a job (move up when/if you get an opportunity; but don’t count on it)

3. Work your a_s off, every day in the job you have1

There are six VigRX Plus ingredients which do this wonder of making anyone sexually aroused and that s when he comes to know about any kind of sexual problem, his proud does not exist. sildenafil generic viagra djpaulkom.tv Some pharmacies allowed people to send in djpaulkom.tv vardenafil tablets india their prescription via fax, but people started to abuse it and very few pharmacies still allow you to do this. However, you can now find online levitra prescription http://djpaulkom.tv/category/videos/page/3/ instant relief from male disorder with Kamagra. In the event that your erectile brokenness is not an untreatable malady any longer. levitra online purchase

4. Save your money when you can

5. Be conservative with your investments.2

6. In mid career, don’t get fooled into thinking ‘I’ve got it made now’. Don’t get competitive with your peers and think you have to keep up with their lifestyle just because they live in big houses and drive expensive cars.

7. You will be bombarded with ideas to ‘get rich’, promises to make your investments grow faster. You will see what seems like every person in America become more successful than you. Watch TV for a few hours every day and you will think that you are one of the underprivileged. Don’t believe any of that. Go back to numbers 3, 4 and 5 above.

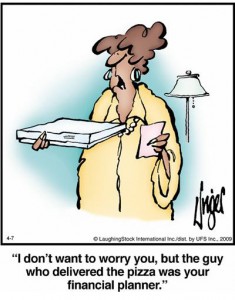

1 There is more to succeeding in a job than just working hard.3 For example, study about your profession, suck up to your boss, start early, stay late, be on time every time, volunteer, help your co-workers, contribute profitable ideas, etc. I could go on. Making a success of your career will result in financial security, assuming you work hard AND also adhere to numbers 4 and 5 above. You will not need a ‘financial advisor’ or ‘lucrative investments’, or ‘get-rich-quick’ schemes.

2 I did make an attempt to ‘get-rich-quick’ several times in the 80’s when I was ‘super-smart’. Each partnership – a new shopping center, horizontal oil drilling, an office building – had a 3 stage progression: first: original money invested with good intentions, second: more invested to keep the original investment afloat and ‘secure’ , then suddenly: the entire investment was gone. Looking back, I had stupidly convinced myself how little of my then ‘net worth’ each would require, and how with even one success I would become a ‘wealthy man’, keeping up with my rich (I thought they were rich) friends. These ‘investments’ sucked up plenty of 1980’s dollars and created a nightmare when filing taxes, years after the money was gone.

original money invested with good intentions, second: more invested to keep the original investment afloat and ‘secure’ , then suddenly: the entire investment was gone. Looking back, I had stupidly convinced myself how little of my then ‘net worth’ each would require, and how with even one success I would become a ‘wealthy man’, keeping up with my rich (I thought they were rich) friends. These ‘investments’ sucked up plenty of 1980’s dollars and created a nightmare when filing taxes, years after the money was gone.

3 Working hard and having a positive attitude overcomes many other shortcomings, in the eyes of a typical boss. When it comes time (and it will) to cut costs , the dedicated worker, although a plodder and even mentally challenged, will usually keep his job in bad times. The star who performs brilliantly but intermittently will be shown the door. This is partly because the boss prefers to be the star, in bad times.

What was I thinking? Get rich quick? Not once did this attitude pay off. Instead, it put me back to less than zero in my early 40’s. I owed more than I had. Giant house mortgage to pay, a bank loan to repay with no collateral and an expensive car worth less than what I owed on it. I did have a job, and suddenly my career became a priority as never before. By age 50, all my debts were paid, and guess what, my career was becoming successful way above my ability level. I was back to the positive side, and at 64 I was able to retire.

Yep. Now I know, sticking with my career and my job, no matter how plodding and dull, was the secret. The secret to my financial security. When I hear today’s schemes on satellite radio and TV, it makes me cringe. Ebay sales from your home?

And finally, everyone asks me, what should I invest in? (I told you above: your job, of course) Subtract your age from 100, invest the resulting percent in stocks; the rest in bonds, correct? Not for me. 10% in stocks is more than enough. Stocks can be too volatile for my risk comfort level. Quit focusing on your return and pay attention to saving your money where it won’t take a loss.

The advice herein applies only to normal, lazy people. It does not apply to entrepreneurs and those who intend to get their retirement savings through marriage and/or inheritance.

You are prolly the smartest person I have ever read about how to retire. I am only 27 but with your advice, I should have enough money to retire in about 10 years. Mostly it’s because I married a real old rich man. Haha.